A credit score is a three-digit number that can significantly impact your finances. The right score can make or break your loan application and affect the interest rates you pay. It may even influence your ability to get a new apartment or job.

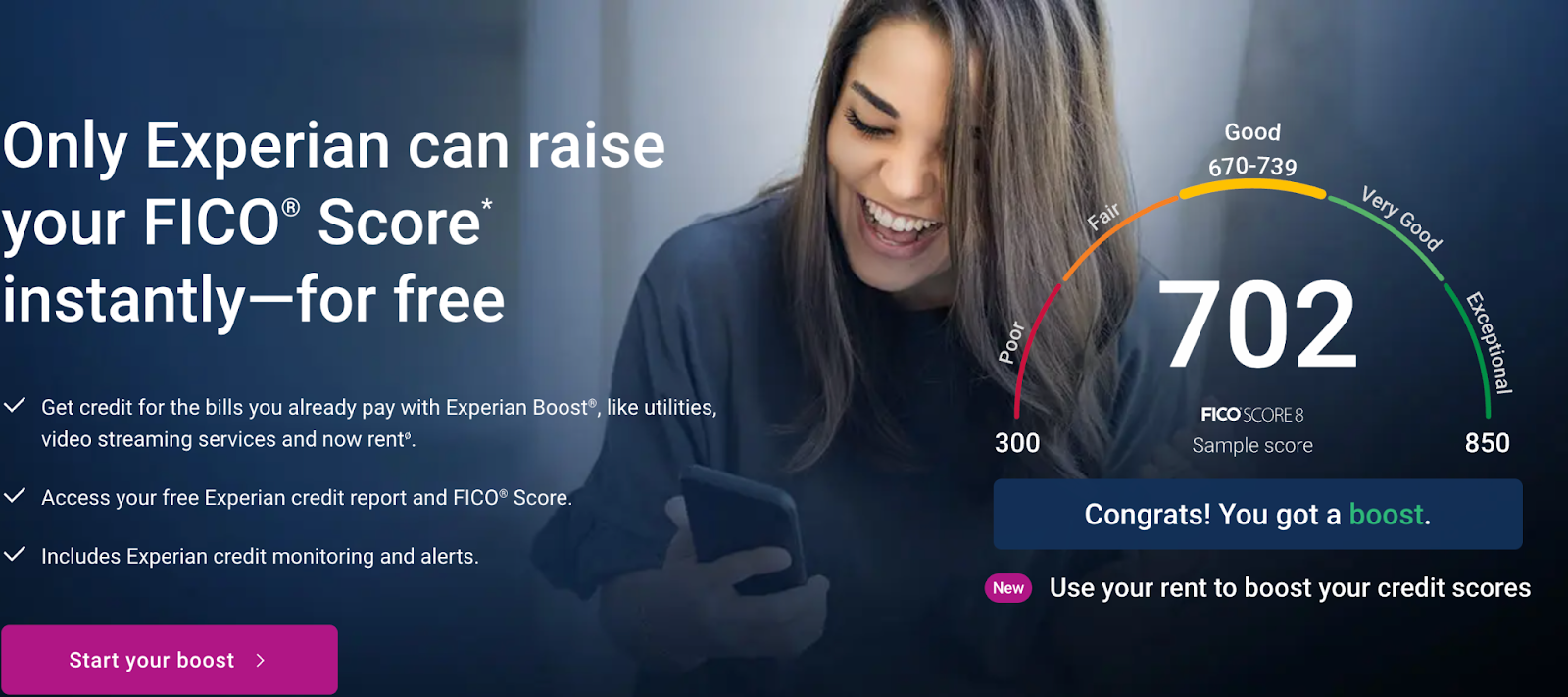

You likely have plenty of reasons to want a higher credit score. Building credit is often easier said than done, but Experian Boost can help you improve your score.

Our Experian Boost review discusses what the tool offers and if it’s the right option for you.

Experian Boost is a service that builds your credit by expanding the scope of your payment history. Instead of only including credit-based bills in your payment history, it lets you pull other on-time payment information into your Experian credit report.

This is important as payment history is one of the largest components of a credit score. A regular record of on-time payments can give your profile a boost.

This is helpful when a bank or card issuer is looking at your profile to determine whether or not to extend you an offer.

In contrast, a spotty payment record could drag your credit score down and result in higher interest rates from lenders or credit card companies.

In short, the service helps you build credit without a credit card and improve your creditworthiness.

Experian Boost is free to use. It lets you connect your bank and credit-based accounts at no cost.

You also receive access to services like credit monitoring and your FICO Score free of charge.

There is a premium service you can upgrade to for access to auto loans, credit cards, and more through affiliated partners. Fortunately, it’s not a requirement to use Boost.

Experian Boost lets you add positive payment history to your credit report using non-credit bills. In theory, this record of timely payments should help those with poor credit increase their score.

Using the platform, you might be able to build credit through on-time rent payments, streaming service subscriptions, phone bills, utility payments, and more. Regularly paying these bills on time may help you build credit with Experian Boost.

When you add a history of on-time payments to your account, you could see your credit score increase. Of course, the service can only improve your credit score if you pay your bills on time.

To sign up for Experian Boost, you must have at least one account on your credit report that’s been active for at least six months.

Importantly, the service only pulls in positive payment information. If you have negative payment information sprinkled throughout your bank account, it won’t be included in your credit report.

Experian Boost can monitor various non-credit accounts. Here’s a list of some of the bills the service can track:

Some of the most popular bills compatible with Experian Boost include Disney+, Netflix, HBO, Verizon, and Hulu.

The service is unable to track every type of bill. For example, it can only monitor residential rent payments made through certain rent payment platforms.

However, it won’t track rent payments made with cash, check, or mobile payment transfer app.

Additionally, the company can’t track mortgage or auto loan payments.

On average, users receiving a boost from non-rental data saw their FICO Score 8 rise by an average of 13 points. However, your results will vary based on your credit information.

The company only promotes how it will impact your FICO Score 8, not your VantageScore.

Since the service accesses up to 24 months of payment information, you might see your credit score rise immediately. If you don’t have a lengthy payment history for any of your bills, it will take more time to see results.

It’s important to note that not everyone will see results. The Experian site states “Some users may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®.”

Experian is one of the three major credit bureaus. When you use Boost, any payment information it collects is only reported on your Experian credit report.

Unfortunately, the company doesn’t report to TransUnion or Equifax. This means you won’t see any score improvements from Boost with these credit reporting agencies.

When you sign up for Experian Boost, you’ll get free access to credit monitoring alerts. If the bureau notices a change to your credit score, you’ll receive a notification.

Additionally, Experian will send you an update anytime new credit activity is reported to your account.

A final perk of this free program is easy access to your Experian credit report. As you build your credit history, you can monitor changes to your credit score.

Plus, you’ll get free access to your FICO score.

The ability to check your credit reports can help you see exactly how the service is helping your credit score.

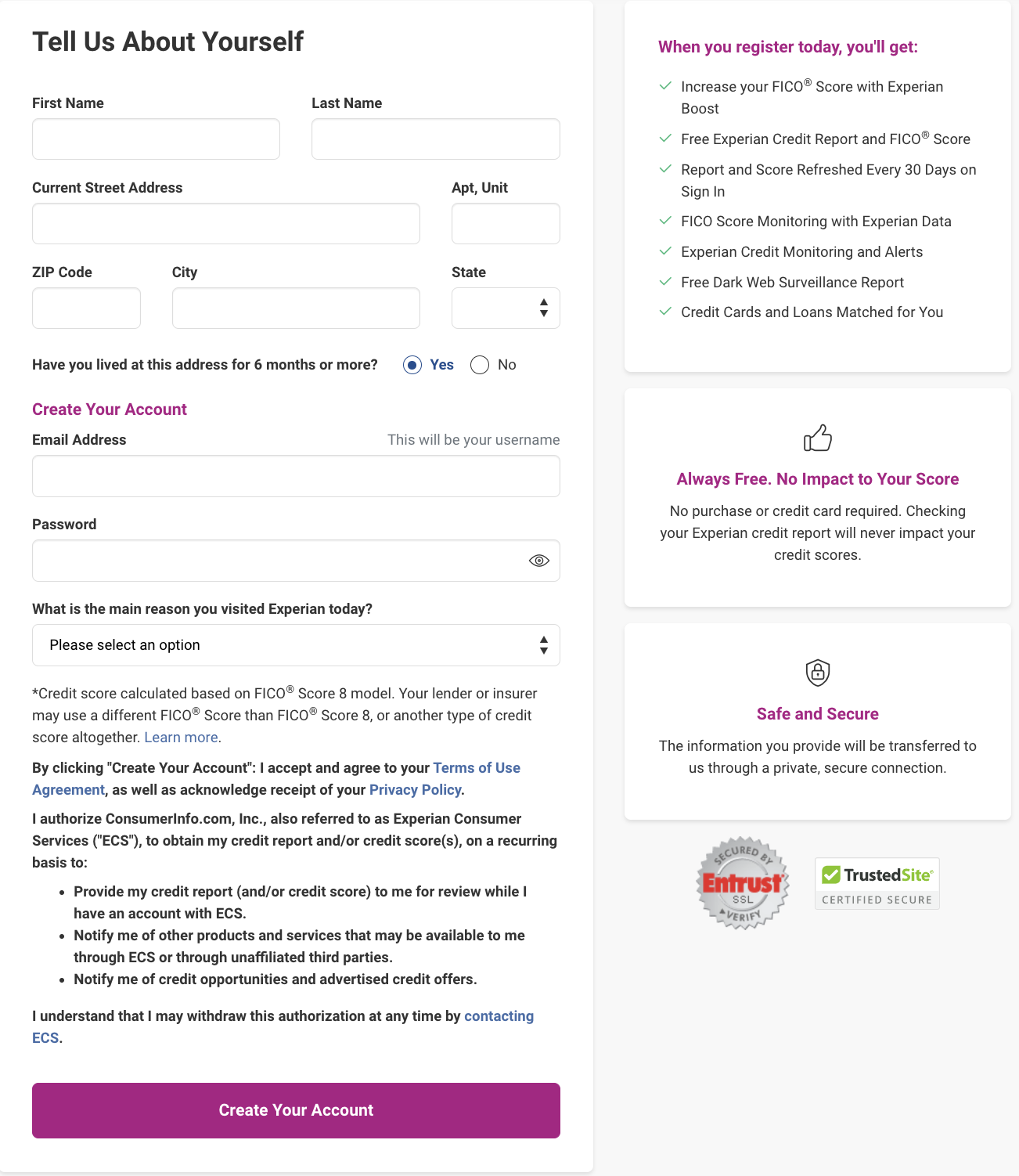

If you are interested in working with Experian Boost, creating an account is easy. You can get started in just a few simple steps.

First, you can create an account through the Experian mobile app or the website.

Be prepared to provide personal information like your name, contact details, and the last four digits of your Social Security number. You’ll also answer several security questions.

Adding your non-credit bills is the next step. You can connect your bank accounts or the credit cards you use to pay bills.

Once your payment method is connected, you’ll need to choose which bill payments should be added to boost.

With all of your designated bills added, it’s time to sit back and monitor your progress.

Take the time to check your credit report regularly. If you notice any issues, you can dispute the information with Experian.

As you raise your credit score, you may gain access to better credit offers. Building a higher credit score can help you improve your finances by tapping into lower interest rates and better rewards.

Most people looking for ways to build credit can join Experian Boost. However, there are some specific requirements you must meet before registering for the service.

These include:

If you meet the requirements and want to work on your credit score, you can join Experian Boost.

However, if you have a limited credit history, you’ll need to apply for a line of credit before getting started. Or, if you are building credit from scratch, a secured credit card or credit builder loan might be a good place to get started.

Every financial tool has advantages and disadvantages. Here’s what to keep in mind when it comes to Experian Boost.

Pros:

Cons:

The service is a good tool to help your finances, but it’s not the only resource at your disposal. Actively lowering your credit utilization ratio and paying off debt are often equally (if not more) helpful.

Yes, Experian Boost is safe to use. The platform utilizes bank-level security to keep your personal data safe.

Additionally, the service is user-driven. If you don’t want to add payment history for a particular bill, you can remove it at any time.

Experian Boost offers an opportunity to boost your credit score. Cumulatively, the service has helped its users grow their credit scores by millions of points. But before you sign up, it’s important to understand the limitations of the tool.

The company reports average point increases of 13 points to their FICO Score 8. However, results vary based on your unique situation.

Experian provides the disclaimer that some users might not see any increase in their score. Plus, users who do see their score rise might not find higher approval odds.

Puneet Thiara, CFA and co-founder of Peach, explains, “many lenders are still using traditional credit scores in their underwriting and decisioning models like FICO 8.0, which don’t incorporate rent payments in their formula.”

Thiara continues, “So subscribing to a service like Experian Boost might boost your headline credit score at the bureaus the rental reporting service reports to, but it doesn’t mean a lender will see those improvements or benefits when deciding what APR to offer you or approve you for a loan.”

You might see your score jump with the help of Experian Boost. However, the jury is still out on whether or not the increase will help you when applying for a loan.

Ultimately, it comes down to what credit score information the lender looks at when reviewing your credit.

Experian Boost isn’t the only service trying to help people with poor or insufficient credit history.

Here’s a breakdown of some other credit-building options.

Credit Karma offers free access to credit scores and credit reports. You can track your credit-building progress over time through the platform.

The company’s credit score simulator feature is a helpful way to see how changes you make could impact your credit score. For example, you can get an idea of how opening a new credit card might affect your credit score.

Credit Karma doesn’t pull in extra payment information, but it can help you estimate your approval odds before applying for new lines of credit.

Self offers credit builder loans. These unique loans are designed to help you build credit from scratch while increasing your savings.

When you take out a credit builder loan, you won’t receive any funds upfront. Instead, you’ll start making monthly payments, which are reported to Equifax, Experian, and TransUnion.

At the end of the loan term, you’ll get access to the savings you built along the way.

If you make on-time bill payments with Self, it’s possible to increase your credit score. Self might be a better option for new credit users who’ve never had a credit account.

It’s also a good solution to diversify your credit mix, which is great for boosting your score.

Read our Self review to learn more.

If you are looking for a place to scope out your credit reports from all three credit bureaus, you have that option through myFICO. While myFICO doesn’t pull in new payment information, it lets you see your credit score at each bureau.

The obvious downside to my FICO is the cost. You’ll pay between $19.95 and $39.95 per month. Depending on your needs, adding this bill to your budget might not be necessary.

Experian Boost Review

Experian Boost is a service that helps improve your FICO credit score by including payment history from bills not normally included in the scoring model.

Pros

The service is free to use

The service is free to use

Includes non-credit account payment history in your score

Includes non-credit account payment history in your score

Late payment history isn’t reported

Late payment history isn’t reported

The service offers credit monitoring alerts

The service offers credit monitoring alerts

You get to select what bills to include

You get to select what bills to include

Cons

You can’t use the service if you’re new to credit

You can’t use the service if you’re new to credit

No guarantee of credit score improvement

No guarantee of credit score improvement

Only impacts your Experian score

Only impacts your Experian score

Experian Boost offers a free opportunity to build your credit score in a unique way. If one of your financial goals is to have a better score, taking advantage of the service could help.

While the results vary, you might see a worthwhile bump to your score.

What are you doing to actively improve your credit score?

The post Experian Boost Review: Does Experian Boost Really Work? appeared first on Frugal Rules.

You likely have plenty of reasons to want a higher credit score. Building credit is often easier said than done, but Experian Boost can help you improve your score.

Our Experian Boost review discusses what the tool offers and if it’s the right option for you.

What is Experian Boost?

Experian Boost is a service that builds your credit by expanding the scope of your payment history. Instead of only including credit-based bills in your payment history, it lets you pull other on-time payment information into your Experian credit report.

This is important as payment history is one of the largest components of a credit score. A regular record of on-time payments can give your profile a boost.

This is helpful when a bank or card issuer is looking at your profile to determine whether or not to extend you an offer.

In contrast, a spotty payment record could drag your credit score down and result in higher interest rates from lenders or credit card companies.

In short, the service helps you build credit without a credit card and improve your creditworthiness.

How Much Does Experian Boost Cost?

Experian Boost is free to use. It lets you connect your bank and credit-based accounts at no cost.

You also receive access to services like credit monitoring and your FICO Score free of charge.

There is a premium service you can upgrade to for access to auto loans, credit cards, and more through affiliated partners. Fortunately, it’s not a requirement to use Boost.

How Does Experian Boost Work?

Experian Boost lets you add positive payment history to your credit report using non-credit bills. In theory, this record of timely payments should help those with poor credit increase their score.

Using the platform, you might be able to build credit through on-time rent payments, streaming service subscriptions, phone bills, utility payments, and more. Regularly paying these bills on time may help you build credit with Experian Boost.

When you add a history of on-time payments to your account, you could see your credit score increase. Of course, the service can only improve your credit score if you pay your bills on time.

To sign up for Experian Boost, you must have at least one account on your credit report that’s been active for at least six months.

Importantly, the service only pulls in positive payment information. If you have negative payment information sprinkled throughout your bank account, it won’t be included in your credit report.

What Bills Can Experian Boost Monitor?

Experian Boost can monitor various non-credit accounts. Here’s a list of some of the bills the service can track:

- Internet

- Cable and satellite

- Utility payments

- Cell phone bills

- Gas and electricity

- Video streaming services

- Water

- Residential rent (with online payments)

- Power and solar

- Trash

Some of the most popular bills compatible with Experian Boost include Disney+, Netflix, HBO, Verizon, and Hulu.

What Bills Will the Service Not Monitor?

The service is unable to track every type of bill. For example, it can only monitor residential rent payments made through certain rent payment platforms.

However, it won’t track rent payments made with cash, check, or mobile payment transfer app.

Additionally, the company can’t track mortgage or auto loan payments.

How Much Does Experian Boost Raise Your Credit Score?

On average, users receiving a boost from non-rental data saw their FICO Score 8 rise by an average of 13 points. However, your results will vary based on your credit information.

The company only promotes how it will impact your FICO Score 8, not your VantageScore.

Since the service accesses up to 24 months of payment information, you might see your credit score rise immediately. If you don’t have a lengthy payment history for any of your bills, it will take more time to see results.

It’s important to note that not everyone will see results. The Experian site states “Some users may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®.”

Does Experian Report to All Three Credit Reporting Agencies?

Experian is one of the three major credit bureaus. When you use Boost, any payment information it collects is only reported on your Experian credit report.

Unfortunately, the company doesn’t report to TransUnion or Equifax. This means you won’t see any score improvements from Boost with these credit reporting agencies.

Credit Monitoring Alerts

When you sign up for Experian Boost, you’ll get free access to credit monitoring alerts. If the bureau notices a change to your credit score, you’ll receive a notification.

Additionally, Experian will send you an update anytime new credit activity is reported to your account.

Free Credit Reports

A final perk of this free program is easy access to your Experian credit report. As you build your credit history, you can monitor changes to your credit score.

Plus, you’ll get free access to your FICO score.

The ability to check your credit reports can help you see exactly how the service is helping your credit score.

How to Create an Experian Boost Account

If you are interested in working with Experian Boost, creating an account is easy. You can get started in just a few simple steps.

Open an Account

First, you can create an account through the Experian mobile app or the website.

Be prepared to provide personal information like your name, contact details, and the last four digits of your Social Security number. You’ll also answer several security questions.

Add Your Monthly Bills

Adding your non-credit bills is the next step. You can connect your bank accounts or the credit cards you use to pay bills.

Once your payment method is connected, you’ll need to choose which bill payments should be added to boost.

Monitor Your Progress

With all of your designated bills added, it’s time to sit back and monitor your progress.

Take the time to check your credit report regularly. If you notice any issues, you can dispute the information with Experian.

As you raise your credit score, you may gain access to better credit offers. Building a higher credit score can help you improve your finances by tapping into lower interest rates and better rewards.

Who Can Join Experian Boost?

Most people looking for ways to build credit can join Experian Boost. However, there are some specific requirements you must meet before registering for the service.

These include:

- Having at least one account on your credit report that has been active for six months

- Having at least one account on your credit report that has made a report to a credit bureau within the last six months

- Not being listed as ‘deceased’ on your credit report

If you meet the requirements and want to work on your credit score, you can join Experian Boost.

However, if you have a limited credit history, you’ll need to apply for a line of credit before getting started. Or, if you are building credit from scratch, a secured credit card or credit builder loan might be a good place to get started.

Pros and Cons

Every financial tool has advantages and disadvantages. Here’s what to keep in mind when it comes to Experian Boost.

Pros:

- Use non-credit accounts to build your credit score

- Free to use

- Late payments are not reported, so it won’t give you a lower credit score

- Potentially unlock a higher credit score

- Credit monitoring alerts

Cons:

- Won’t help your Equifax or TransUnion credit reports

- No credit repair feature

- You must link a bank account

The service is a good tool to help your finances, but it’s not the only resource at your disposal. Actively lowering your credit utilization ratio and paying off debt are often equally (if not more) helpful.

Is Experian Boost Safe to Use?

Yes, Experian Boost is safe to use. The platform utilizes bank-level security to keep your personal data safe.

Additionally, the service is user-driven. If you don’t want to add payment history for a particular bill, you can remove it at any time.

Does Experian Boost Really Work?

Experian Boost offers an opportunity to boost your credit score. Cumulatively, the service has helped its users grow their credit scores by millions of points. But before you sign up, it’s important to understand the limitations of the tool.

The company reports average point increases of 13 points to their FICO Score 8. However, results vary based on your unique situation.

Experian provides the disclaimer that some users might not see any increase in their score. Plus, users who do see their score rise might not find higher approval odds.

Puneet Thiara, CFA and co-founder of Peach, explains, “many lenders are still using traditional credit scores in their underwriting and decisioning models like FICO 8.0, which don’t incorporate rent payments in their formula.”

Thiara continues, “So subscribing to a service like Experian Boost might boost your headline credit score at the bureaus the rental reporting service reports to, but it doesn’t mean a lender will see those improvements or benefits when deciding what APR to offer you or approve you for a loan.”

You might see your score jump with the help of Experian Boost. However, the jury is still out on whether or not the increase will help you when applying for a loan.

Ultimately, it comes down to what credit score information the lender looks at when reviewing your credit.

Alternatives to Experian Boost to Improve Your Credit

Experian Boost isn’t the only service trying to help people with poor or insufficient credit history.

Here’s a breakdown of some other credit-building options.

| Service | Mo. Cost | Best For | Try |

|---|---|---|---|

| Experian Boost | Free | Non-credit payments | Try |

| Credit Karma | Free | Credit monitoring | Try |

| Self | Varies | Credit builder loans | Try |

| myFICO | $19.95+ | Monitor all three agencies | Try |

Credit Karma

Credit Karma offers free access to credit scores and credit reports. You can track your credit-building progress over time through the platform.

The company’s credit score simulator feature is a helpful way to see how changes you make could impact your credit score. For example, you can get an idea of how opening a new credit card might affect your credit score.

Credit Karma doesn’t pull in extra payment information, but it can help you estimate your approval odds before applying for new lines of credit.

Self

Self offers credit builder loans. These unique loans are designed to help you build credit from scratch while increasing your savings.

When you take out a credit builder loan, you won’t receive any funds upfront. Instead, you’ll start making monthly payments, which are reported to Equifax, Experian, and TransUnion.

At the end of the loan term, you’ll get access to the savings you built along the way.

If you make on-time bill payments with Self, it’s possible to increase your credit score. Self might be a better option for new credit users who’ve never had a credit account.

It’s also a good solution to diversify your credit mix, which is great for boosting your score.

Read our Self review to learn more.

myFICO

If you are looking for a place to scope out your credit reports from all three credit bureaus, you have that option through myFICO. While myFICO doesn’t pull in new payment information, it lets you see your credit score at each bureau.

The obvious downside to my FICO is the cost. You’ll pay between $19.95 and $39.95 per month. Depending on your needs, adding this bill to your budget might not be necessary.

Experian Boost Review

- Cost

- Ease of Use

- Availability

- Credit help

- Tools

Experian Boost Review

Experian Boost is a service that helps improve your FICO credit score by including payment history from bills not normally included in the scoring model.

Overall

4.1Pros

Cons

Bottom Line

Experian Boost offers a free opportunity to build your credit score in a unique way. If one of your financial goals is to have a better score, taking advantage of the service could help.

While the results vary, you might see a worthwhile bump to your score.

What are you doing to actively improve your credit score?

The post Experian Boost Review: Does Experian Boost Really Work? appeared first on Frugal Rules.